3rd Pillar – Voluntary contributions

Typically, the 1st and 2nd Pillars combined will not meet your future income needs after retirement. Pillar 3 allows you to save money efficiently and bridge the savings gap for retirement.

Pillar 3 is divided into Pillar 3a (restricted) and Pillar 3b (unrestricted).

Payments are voluntary, the key benefit is that you’ll save on taxes with Pillar 3a because you can deduct the contributions from your taxable income.

3a – Restricted pension plan

Why should you invest in Pillar 3a?

The main advantage of Pillar 3a over other saving options is its tax relief. How much you save depends on your contributions, income, marital status, number of children and retirement plan. If you are employed, you can pay up to CHF 6,883 (2022) into your 3rd Pillar each year.

Self Employed

For those who are self employed in Switzerland (independent status), the system is somewhat different. Here, whilst you are entitled to establish a second pillar plan for yourself, for the third pillar you may contribute up to 20% of your annual earned (taxable) income, with a maximum level of CHf34’416 (2022).

Please note this applies only to those without an active occupational (second pillar) pension scheme.

When can you gain access to your Pillar 3a?

You can withdraw your 3a retirement savings from between 5 years before retirement age to 5 years after. If you continue working after the standard age of retirement, you can also delay withdrawing your savings from the 3a pillar fund (still, until up to 5 years after retirement age).

When making withdrawals, your savings are taxed at a reduced rate.

Under certain situations, it is possible to make a withdrawal before retirement age, for example, when:

- You leave Switzerland

- You get a mortgage for your own home

- You become self-employed

- You receive a full Swiss disability insurance pension

- You want to transfer the fund into another pension fund

SHOULD YOU CHOOSE A BANK

OR AN INSURANCE COMPANY?

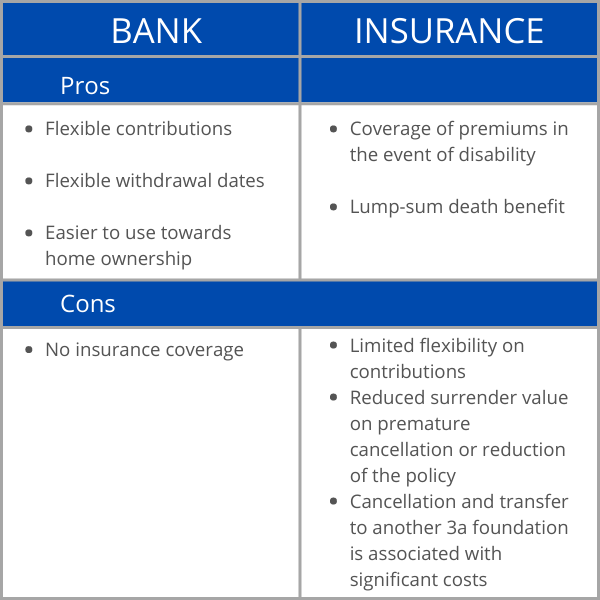

With either a bank or an insurance company, your 3rd Pillar is frozen until retirement and tax offices do not differentiate between bank and insurance solutions.

Insurance solution

A Pillar 3a account with an insurance company often combines savings with an insurance policy.

You not only pay savings contributions for your pension, but also premiums for risk coverage for disability or death. Frequently, a waiver of premiums in the event of disability is also included, so the insurance company will contribute to your Pillar 3a if you become unable to work. This affects the cost of your premiums and your Pillar 3a fun will be lower on retirement than with a 3a solution without risk coverage. In addition, insurance policies often expire at the same time as your retirement date.

Bank solutions

Banks do not include risk coverage and are more flexible with contributions, which means that you can contribute with different amounts each year. You can take out independent insurance if you want to be protected in case of disability or death, as with the insurance companies.

DID YOU KNOW…

Under certain conditions, you can use your 3rd Pillar to finance renovations and refurbishments for an owner-occupied property in Switzerland.

Beneficiaries in the event of death

If you die intestate (without a valid will), statutorily beneficiaries will be:

1. Your spouse

2. Your direct descendants

In some cases, persons who were supported by the descendants, or the person with whom the descendant lived in a domestic partnership for the last 5 years prior to death, or who is responsible for supporting joint children.

3. Your parents

4. Your siblings

3b – Unrestricted pension plan 3b

Pillar 3b is a category of different private retirement savings funds which are not tax- privileged. This category includes:

• 3b retirement funds

• 3b retirement accounts

• 3b life insurance policies

There is no limit on how much can be contributed to 3b retirement savings or to withdrawals of 3b assets, but they are not tax deductible so generally speaking it is not such a tax efficient solution for most individuals.

Under certain conditions, Pillar 3b solutions can be held by individuals who do not reside in Switzerland.

Email to info@blackdenfinancial.com or phone +41 22 755 0800

Or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.