Inflation

Cash is King, or so we are often told. But is that really correct?

Most of us are, in fact, aware that whilst cash most definitely has a place in our portfolios, most notably for short term needs, holidays, car or house repairs, school fees or even an imminent house deposit, holding too much cash for anything other than a short time can be costly for our wealth, and this is particularly true in times of high inflation.

Annual rates of inflation are currently in high single digit figures in many countries, even hitting double digit in countries such as the UK. In such a scenario, with inflation at 10%, the nominal value of £100 today will still be £100 in a year’s time, however the buying power, also known as the real value, will be just £90 in a year’s time.

And although the increase in interest rates which is driving inflation means that finally, after years of zero or negative returns on bank savings accounts, a return is available, it’s unlikely to be any higher than 3.5% (UK rates), with many accounts yielding much lower.

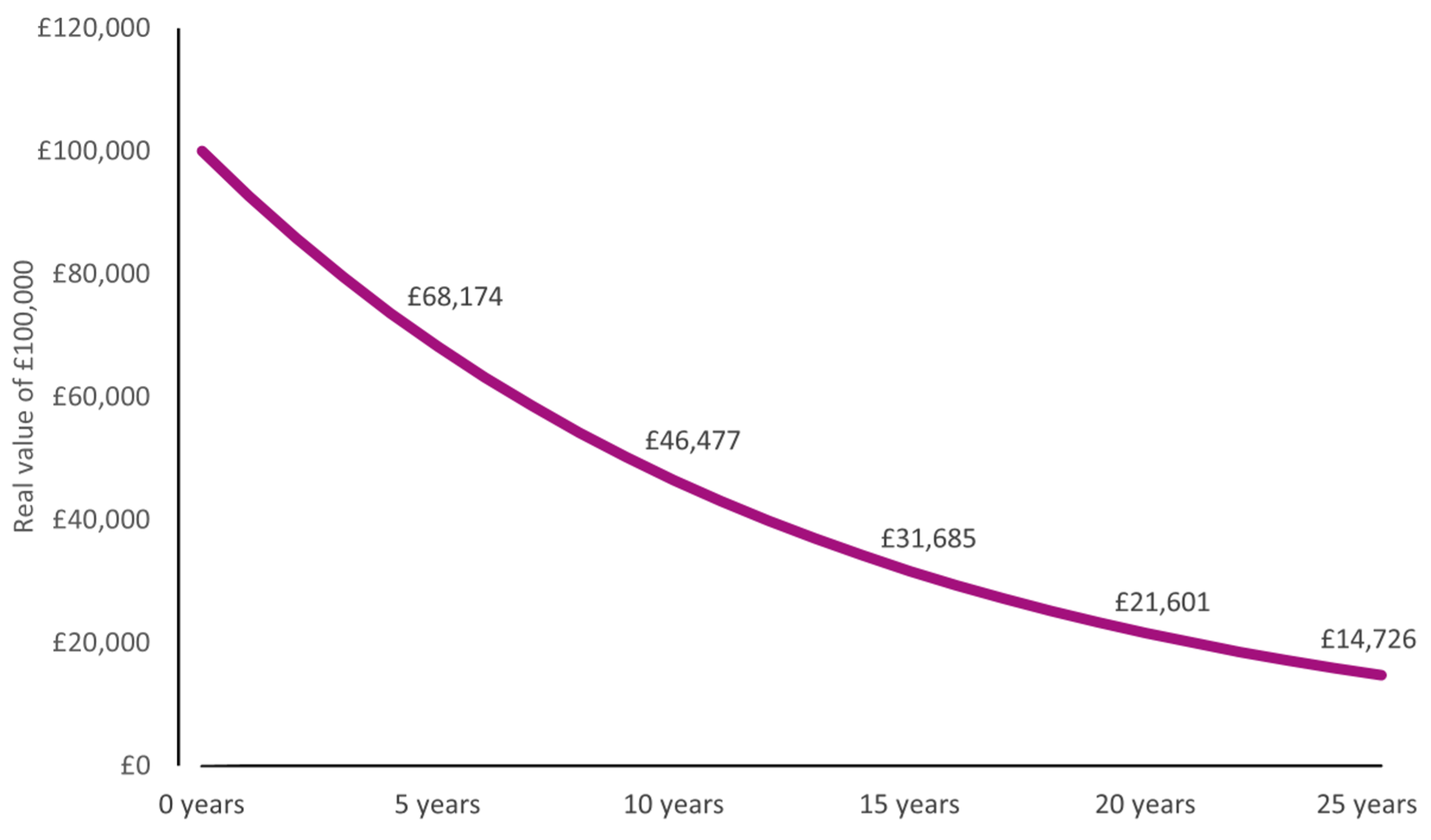

In this case there is therefore a real loss in value of at least 6.5% a year. In other words, you are 6.5% less well off in a year as a consequence. One year like this may not be too bad, especially in a situation where markets have been so volatile as in the last 12 months, however the compounding effect of inflation can be catastrophic on your wealth over the longer term, as the following chart shows.

Chart 1 shows how the real value of cash would dwindle if the 6.5% annual decline were to continue into the future.

Chart 1: The real impact of inflation on cash

The chart looks at the real value of £100,000 held in a current account offering the highest interest rates. Over ten years, cash held in this current account would lose more than half of its value in real terms. Over 15 years it would lose more than two-thirds of its value and, over 25 years, it would lose more than 85 per cent of its value in real terms.

Of course, this chart is only for illustration; inflation is not expected to remain so high over such a long period of time. None the less, if inflation drops so will returns on savings accounts, and so what the chart really illustrates is the real impact on cash of high inflation.

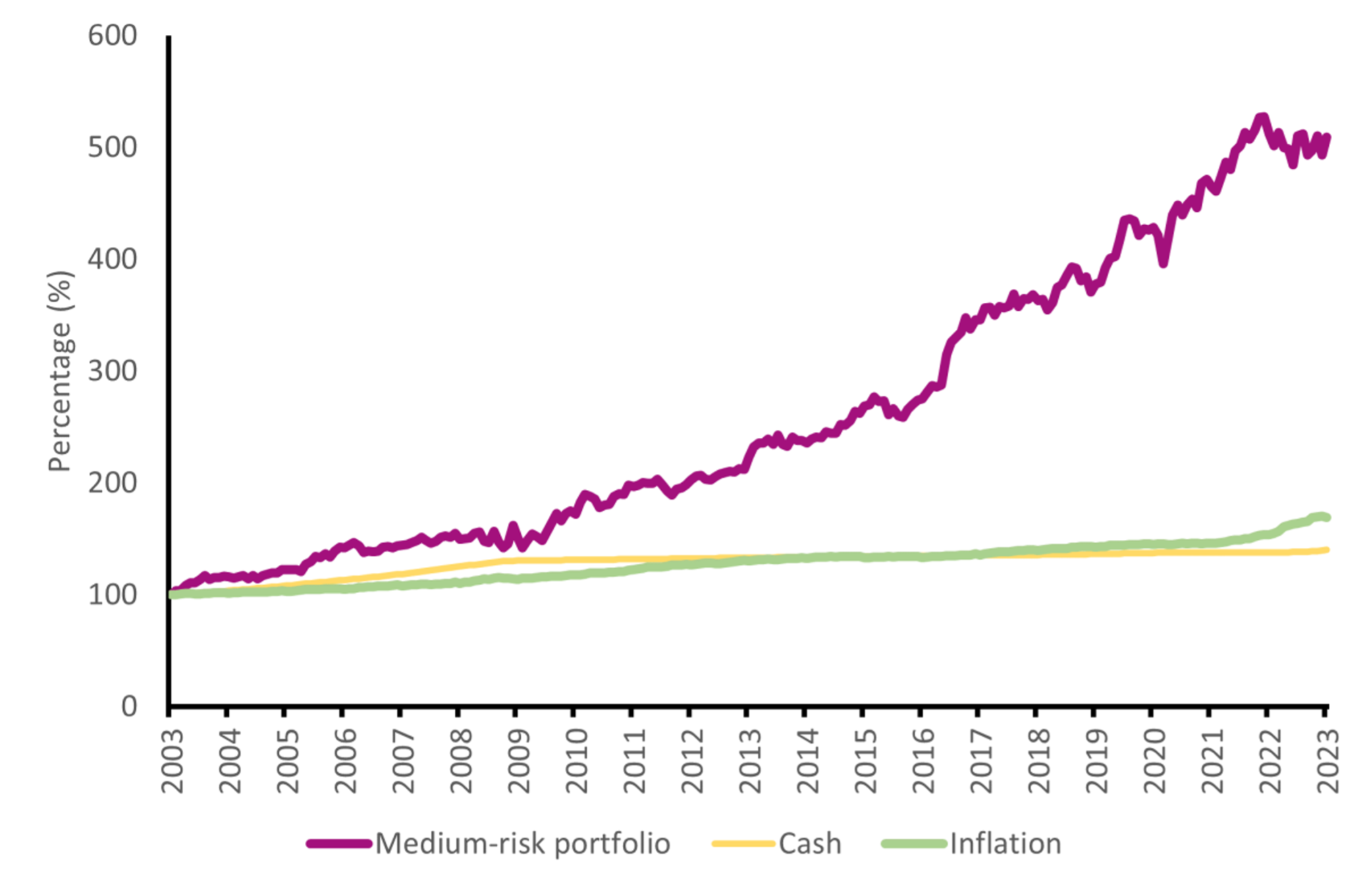

Chart 2 shows how a medium-risk portfolio, comprising 60 per cent global equity assets (shares) and 40 per cent global bonds, significantly outpaced both cash and inflation in the 20 years to January 2023. This portfolio of broad-based assets is based on a 60 per cent allocation to the MSCI World index of global equity assets and a 40 per cent allocation to the Bloomberg Global Aggregate Bonds index.

60 / 40 Balanced Risk Portfolio

Chart 2: How a medium-risk portfolio has performed against cash and inflation

Behavioural Finance Biases

Behavioural Finance Research suggests, however, that many of us tend to view our income and wealth in nominal rather than real terms, an effect known as ‘money illusion’. This is unfortunate because it means we can overestimate the future buying power of cash savings because we are not fully taking into account the impact of inflation. We also tend to underestimate the future potential values of stock market equity assets, an effect known as ‘exponential growth bias’.

Looking again at Chart 2, the fact that the medium-risk portfolio has performed relatively strongly in the past does not mean it will do so in the future, of course. But it does draw attention to a key risk of holding cash for the long term and the risk that investors could miss out on strong potential returns from other assets such as shares.

Counterparty Risk

There is, however, another risk in holding too much cash. This is known as counterparty risk, and most of us became aware of it in 2007 – 2008 in the Great Financial Crisis, when major banks globally needed to be supported by central banks. The UK had to enact terrorist legislation to prevent assets leaving the UK from the Icelandic banks and in Ireland there was such a run on the banks that the central bank of Ireland had to step in and confirm it would backstop all Irish banks 100% just to stop the run.

Counterparty risk (in so far as it concerns a bank) is the risk that the bank where you have deposited your money defaults on its obligation due to too many withdrawals in a short space of time, also known as a ‘run on the bank’. This happened in 2007 when huge queues formed outside Northern Rock in the UK seeking to withdraw their money. Today, with online banking being so widely available, and social media magnifying everything, good or bad, such moves can be lighting fast. This was witnessed with the collapse of SVB bank in the USA recently, causing the 16th largest bank in the USA to collapse almost overnight.

Of course, since 2008 most banks are generally considered safe, but the level of safety can vary depending on a number of factors. These may include domestic legislation – in the USA for example, a bank is considered of systemic importance when it has assets of $250Bn or above whereas in Europe this level is a mere €10Bn. The risk level can also depend on the country’s economic and political stability, the bank’s reputation, and the specific products and services offered by the bank.

Most developed countries have regulatory bodies that oversee and regulate banks to ensure that they operate within the law and maintain adequate reserves to protect depositors. These regulatory bodies also conduct regular audits to ensure that the banks are financially stable and able to meet their obligations.

In addition, many banks offer insurance on deposits up to a certain amount, which provides an additional layer of protection for depositors. However, it’s important to note that this insurance typically only covers deposits up to a certain amount and does not cover investments or other financial products.

As we have seen in Switzerland recently, even major international banks such as Credit Suisse can collapse when confidence is lost, and whilst the notion of ‘too big to fail’, an expression first coined in the 2007-2008 Global Financial Crisis, may still apply in many cases, with depositor protection in much of Europe limited to €100,000 per client per bank, there is a clear risk beyond this level.

Overall, while no bank is completely immune to risk, banks are generally considered to be safe places to store money. It’s important to do your own research and due diligence to choose a reputable bank that meets your specific needs and offers the level of safety and protection you require.

What this does mean, however, is that despite the volatility witnessed over the last few years, and whilst there is no guarantee that future returns will mirror past returns, investing in real assets such as equities, bonds and property is likely to generate greater returns than remaining in cash.

Not only that, but since assets such as the shares/bonds portfolio described above are all typically held ‘off balance sheet’, you don’t have the same liability as keeping cash which always remains on the bank’s balance sheet and so is at risk.

For further information

Ensure your money is in safe hands, get in touch today and book your free no-obligation review meeting. You have nothing to lose and potentially lots to gain!

Alternatively, if you are already invested and not happy with the performance of the portfolio and want a second opinion, we are able to offer a free portfolio review service to make sure you are on track to meet your objectives. This can also help protect the real value of your investments from being eroded by inflation. Just get in touch today, you have nothing to lose and potentially lots to gain.

Send us an email to info@blackdenfinancial.com, or complete our Contact Form here.

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.