2nd Pillar – Occupational Pension

Your 2nd Pillar (BVG in German and LPP in French) is a defined contribution occupational pension. If you are employed in Switzerland, age 25 or older and your annual salary is higher than CHF 21,510, then this is a mandatory provision – you must be insured by your employer.

How much are your contributions?

Your contributions are a percentage of your insured salary based on your age.

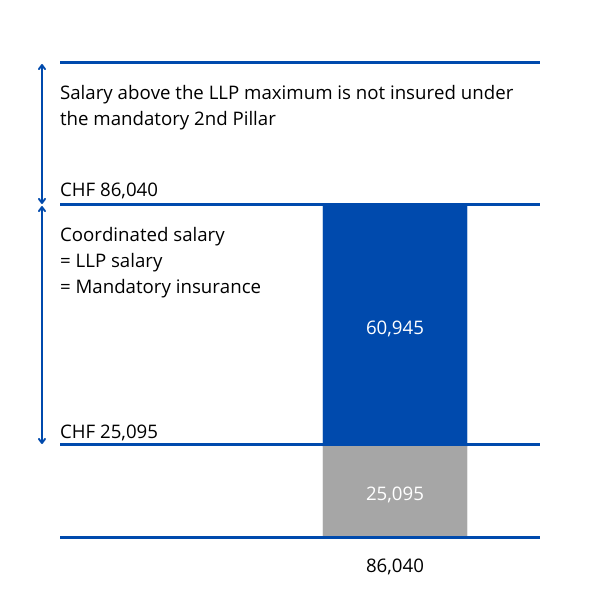

The mandatory insured salary is the difference between your current salary and 7/8 of the 1st pillar maximum yearly salary (7/8 of CHF 28,680 = CHF 25’095). This means, your insured salary will be your gross salary minus CHF 25’095.

Thereafter the rate increases with age from 7% to 18% p/a of the insured salary. For the mandatory insured salary, your employer must at least match your contribution.

If your salary is greater than CHF 86’040 per year, your employer often provide benefits with a much higher ceiling of contributions, although this is neither automatic nor legally required. These contributions are known as ‘extra mandatory’ contributions, ‘ Sur Obligatoire’ in French.

Voluntary purchases

Voluntary purchases, (also known as ‘Rachat’, or ‘buybacks’), into your 2nd pillar are often an attractive savings option when you are closer to retirement age. They are tax-deductible (within contributory limits) and, under certain conditions, they offer certain flexibility if you want to access the money before retirement, e.g. for buying a home.

By working for longer and at a higher income, you are able to execute a greater number of voluntary purchases (investments) and so you receive a greater level of tax relief. Switzerland has a progressive tax system, which means that low incomes are taxed with low rates, whereas higher incomes are subject to progressively higher levels of tax.

It is important to note that it is only possible to buy into your pension fund if there is a pension shortfall. Shortfalls occur when you have a break in your career for, for example, raising your children, study, or simply long holidays. It also applies if, as is often the case for an expat arriving in Switzerland mid- career, you have previously worked abroad for a number of years. In addition, salary increases also entitle you to higher levels of contributions, as the difference between the previous and current salary will result in a natural shortfall, which can be compensated through voluntary purchases throughout different years. You should receive your personal pension statement on a yearly basis and it is via this basis that you can check the potential ‘buyback’ contributions to which you are entitled.

If you are considering early retirement, this is one of the options that you might contemplate. If you do it in advance, you should ideally spread your voluntary purchases across several periods in order to maximize the impact on your tax burden.

If you get divorced, the assets are divided so the partner with the highest pension typically sees their pension reduced. In this case, this regression in the pension benefits can be topped up to the amount before the divorce by making a tax-privileged purchase.

Typically, voluntary purchases belong to the non- compulsory (extra mandatory) portion of your pension assets, which receive a lower rate of interest than the compulsory (mandatory) portion. Moreover, the conversion rate used to calculate the pension is lower for non-compulsory assets than for compulsory assets.

If you have a pension from a previous employer (known as a vested benefits account) that you have not merged with your current employer’s pension fund, it is still classed as pension assets and will be considered when calculating your limits for voluntary purchases.

It is worth noting that any additional voluntary contributions made cannot be accessed within three years of being paid in, so if you plan to take a lump-sum pension in its entirety, you should finalise making any additional contributions into your pension plan at least three years before you retire.

How much will you receive?

Every year, you will receive a pension fund certificate with details about your funds accumulated both as mandatory and extra-mandatory benefits. This document contains the current value of your savings, projections, your future alternatives to access the funds as annuities or a lump sum, and further details depending on your personal situation.

If you want to divide your pension pot into annuities and a lump sum, the conversion rate for the mandatory portion is currently 6.8%. This means 6.8% is the factor which determines how much per year you receive from the part of the lump sum that you want to convert into an annuity. For example, CHF 100.000 would give you an annuity of CHF 6.800 per year.

Pension assets are exempt from wealth tax and any interest is exempt from income tax.

When can you access the funds?

As usual, the standard retirement age is 65 for men and 64 for women. Under certain conditions, you may be able to access your voluntary and non- voluntary contributions before retirement age but, generally, never before age 58 (women) or 59 (men).

Any funds withdrawn before retirement age for the purchase of a home must be paid back before tax- privileged voluntary purchases can be made. The best solution is often to not invest your retirement assets in the purchase of a home, but instead to pledge them and retain your pension plan’s flexibility.

In the case of death – Spouses pension

In case of death, your partner is entitled to 60 % of your retirement pension.

Your partner will be eligible for a surviving spouse’s pension only if he or she has:

- Responsibility to provide support for children, or

- Reached at least age 45 and your marriage lasted at least 5 years

In all other cases, a spouse is entitled to a lump sum of three annual pension payments.

Registered same-sex partnerships are treated the same as spouses, but not co-habitants.

If you are an expat

If you are moving to an EU/EFTA country, the mandatory element of your Pillar 2 benefits cannot be withdrawn. In this situation, the money in your Pillar 2 is deposited in a vested benefit account and will be paid when reaching retirement age.

However, if you are moving to a country outside of the EU/EFTA, all funds in the Pillar 2 can be withdrawn. This is your “libre passage”.

How will you withdraw your 2nd pillar? Annuity or a lump sum?

This is one of the most sensitive decisions you will have to make in your retirement plan. You have three alternatives for withdrawing your pension:

- An annuity (monthly pension)

- Capital withdrawals

- A combination of the two options above. To summarise; What is clear is that there are many advantages and disadvantages in each scenario, so be sure of analysing your specific circumstances in detail before making any decision. For more specific guidelines on how to approach this important decision, see the specific section about annuity or Lump sum options

Email to info@blackdenfinancial.com or phone +41 22 755 0800

Or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.