Making a mistake when investing or simply settling into bad financial habits can set you back hundreds, if not thousands, of whatever currency you invest in, Swiss Francs, Euros, Dollars or any other currency you like. Some blunders are immediately obvious, whereas others might not become apparent until much later in life, at which point the damage may be harder to repair. The following are seven of the most common investment mistakes for to avoid.

1. Ignoring inflation

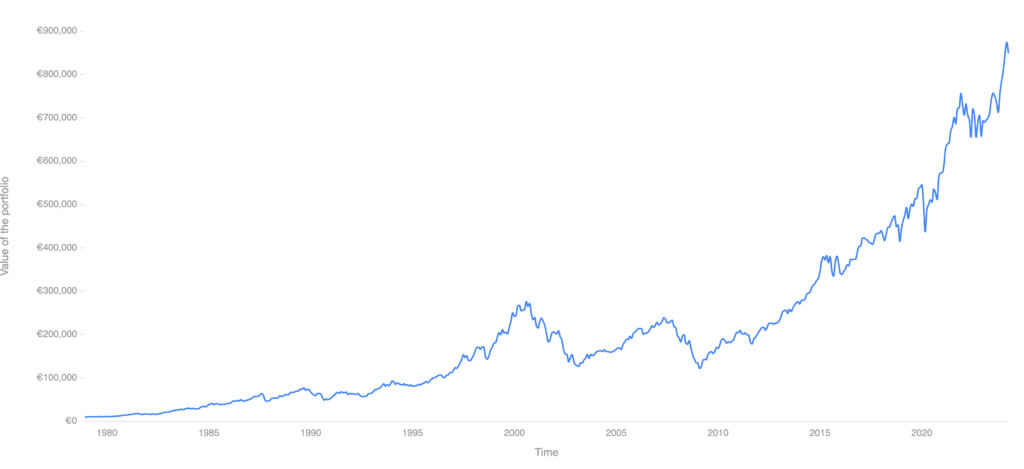

Many people assume that investing is riskier than holding cash and therefore keep all their money in a savings account. However, if the interest rate on your savings account is below inflation, which is usually the case, the return is nominal, and its ‘real’ value (purchasing power) will gradually erode over time. There are several ways to mitigate against the erosive impact of inflation, but history shows us that, over long periods, none have been as consistent as investing in the stock market. In the 45 years between December 1978 and April 2024, the MSCI World index (when measured in Euros) had a compound annual growth rate of 10.31%.

Historical performance of the MSCI World index (https://curvo.eu/backtest/en/market-index/msci-world?currency=eur)

2. Failing to keep a ‘rainy day’ fund

While investing gives your money the opportunity to grow, it’s important to ensure you set aside a ‘rainy day’ fund to pay for emergencies. It’s generally wise to have around six months’ worth of essential expenditure in an easy access account. If your heating system collapses or you receive a large, unexpected bill, your rainy-day fund will prevent you from selling assets that you would otherwise consider as long-term investments.

3. Failing to diversify

We’ve all heard the expression, ‘Don’t put all your eggs in one basket’. When it comes to investing, these are wise words to live by. Nobel Prize laureate Harry Markowitz once quipped that ‘diversification is the only free lunch in investing’. By spreading your investments across different asset classes, including cash, property, infrastructure, shares and bonds, as well as across different sectors and regions, this can help reduce volatility in an investment portfolio, which means you will minimise losses when one type of investment underperforms. Creating a diversified investment portfolio isn’t an easy thing to do, however, and that’s where a discretionary fund manager (DFM) can add real value.

4. Taking a short-term view

The stock market can be volatile, with share prices moving up and down from one week to the next. This is why you should approach investing with a long- term view and invest for at least five years, ideally longer. Investing over the long term gives an investment the chance to recover from stock market downturns and grow in value over time. Warren Buffet has many famous quotes, but his quote on volatility from 1997 always resonates. ‘As an investor, you love volatility. You love the idea of wild swings because it means more things are going to get mispriced’.

5. Making rash decisions

When stock markets tumble, it’s easy for those more unfamiliar with investing to panic. But knee- jerk reactions can leave you in a worse place financially. Selling investments that have fallen in value risks crystallising losses. And if the market suddenly recovers, you could miss out on subsequent gains.

6. Refusing to take a loss

On the flipside, another common mistake is refusing to take a loss and, instead, holding on to an underperforming stock in the hopes the share price will recover. Yet if the investment circumstances have changed, it doesn’t make sense for you to leave your money tied up in a country, sector or company with poor prospects. For example, those who invested in Japan at the peak of the stock market boom in 1989 would have had to wait 35 years to see their fund reach the same level again. Reinvesting into a sector where the prospects are brighter could help get your investments back on track.

7. Following the herd

We all suffer from FOMO at some point in our lives, and behavioural finance experts will tell us that this is especially prevalent when it comes to finance. Inexperienced investors can often copy the investment choices of their friends, neighbours or colleagues, which can easily backfire. Many investments become over- hyped, only to come crashing down months later. Even if the investment does seem solid, it won’t necessarily be right for everyone’s individual circumstances.

The value-add of a fee based independent financial advisor.

When it’s done right, investing allows you to build a more secure financial future; when it’s done wrong, however, the opposite is true, and you not only risk losing money but also jeopardizing your long-term plans.

Working with a fee based independent planner whose interests are aligned with yours allows you to make the most of your financial resources, and helps you avoid some of the most common pitfalls associated with investing.

Next steps

As a firm of fee based financial planners with decades of experience in advising expatriates in Europe, we can help you ensure that your wealth lasts throughout your retirement, no matter how long that may be.

Make an appointment now

At Blackden Financial we have been advising our clients in Switzerland for the past two decades on just such decisions, so for a no obligation meeting call, +41 22 755 0800, by e mail info@blackdenfinancial.com or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.