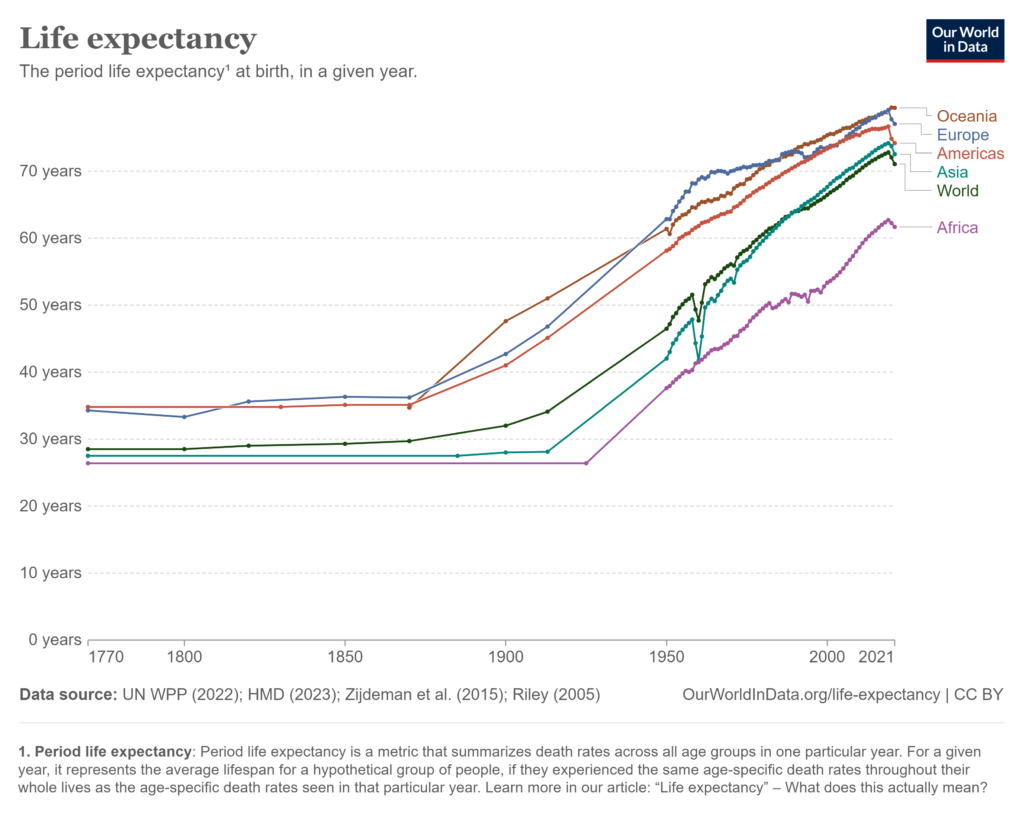

In 1900, the average life expectancy of a newborn was 32 years. By 2021 this had more than doubled to 71 years.

And in certain parts of the world, it is now becoming common to live well beyond this, with average life expectancy in Switzerland currently being 83 years.

These increases in life expectancy mean that a number of us may well one day celebrate our 100th birthday, so even if you retire at age 65, current ‘normal retirement age’ in Switzerland, you may need your retirement funds to last three, or even four decades.

With this in mind, here are some essential questions which may help you plan for a comfortable retirement.

When do you plan to retire?

The age at which you retire will impact your future finances. The longer you work, the less time your money will need to last and the greater chance your money, whether pensions or other investments, have to grow. It was not by accident that Einstein quoted that…

“Compound interest is the eight wonder of the world”.

For some it may be appropriate to take a phased retirement and gradually reduce hours by working part-time or on a consultancy basis. This could help alleviate some of the pressure on pension pots while still allowing you to retain the stimulation and social engagement that work offers.

What are your retirement goals and aspirations?

What does retirement look like for you?

What are your life goals and aspirations?

It’s important to assess what lifestyle you expect to lead in retirement, and most importantly, not to underestimate the costs. As the saying goes, “retirement is the longest holiday of your life, and holidays are expensive”.

Of course it is not always easy to determine future expenditure. In the USA they talk about the three stages of retirement being: ‘Go-Go, Slow-Go and No-Go’! Each stage will differ from person to person, which is why it is essential to take professional advice.

Whilst it may be difficult to predict how your needs and goals could change in later years, a professional, fee-based advisor can make use of specific financial planning tools such as personal cashflow modelling to demonstrate the effects of your decisions and events that may be outside your control.

How much income do you need?

The boxer George Foreman famously said, “Its not about what age I want to retire, but at what income”!

The appropriate strategy will depend on your individual circumstances and ambitions for your retirement, and a “one size fits all” approach is unlikely to work. It is only by assessing future expenditure patterns in detail that are you likely to ensure you meet your future financial retirement objectives.

How should you invest your money?

Investing for a time frame of 30+ years isn’t easy, especially when you can’t predict future expenditure patterns indefinitely. You may wish to keep a portion of your money invested in shares to give it the opportunity to benefit from long-term stock market growth. However, as shares can depreciate, it is important to first assess your attitude to investment risk.

“Diversification still is the only free lunch in investing.”

Spreading money across other assets, such as bonds and cash, or even alternative investments can help reduce the impact of stock market volatility. The proportion of money allocated to each asset class should be in line with your overall attitude to risk, however.

How can you plan for your later life?

This may be referred to as the ‘No-Go’ stage of retirement, and as we all live longer there is a greater chance that our health may deteriorate and we may need to adapt our properties, pay for nursing care, or move into care homes. Care homes can cost thousands per month, so could majorly impact on your wealth.

How can you avoid running out of money?

For most people approaching retirement, this is the question that is most likely to cause sleepless nights.

It is a question that can best be answered by a personalised, comprehensive quantitative financial analysis.

It is only by quantifying the future value of assets you currently have, adding to those you may acquire by retirement (pensions, savings etc) and comparing this against future expenditure, that you can accurately ensure your capital will outlast you, rather than the other way around.

It’s also important to examine potential routes to reduce the amount of income tax paid and the amount of inheritance tax your estate may owe upon death. For some people, downsizing their home or using equity release products may be appropriate – however, there are risks involved.

Do you want to leave a legacy?

Many people want to leave a legacy for their loved ones but funding a 30-year retirement plan and passing on wealth is not always easy, which is why it is important to plan early. Writing a will and structuring investments tax-efficiently are just some of the steps you need to consider.

Beware however the liquidity trap, not leaving yourself with enough readily available capital to meet the varying needs of retirement.

Next steps

As a firm of fee based financial planners with decades of experience in advising expatriates in Europe, we can help you ensure that your wealth lasts throughout your retirement, no matter how long that may be.

Make an appointment now

At Blackden Financial we have been advising our clients in Switzerland for the past two decades on just such decisions, so for a no obligation meeting call, +41 22 755 0800, by e mail info@blackdenfinancial.com or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.