When markets outperform, investors may face what’s sometimes referred to as ‘psychological barriers to entry’, meaning they may question whether it’s the best time to put their money into the market.

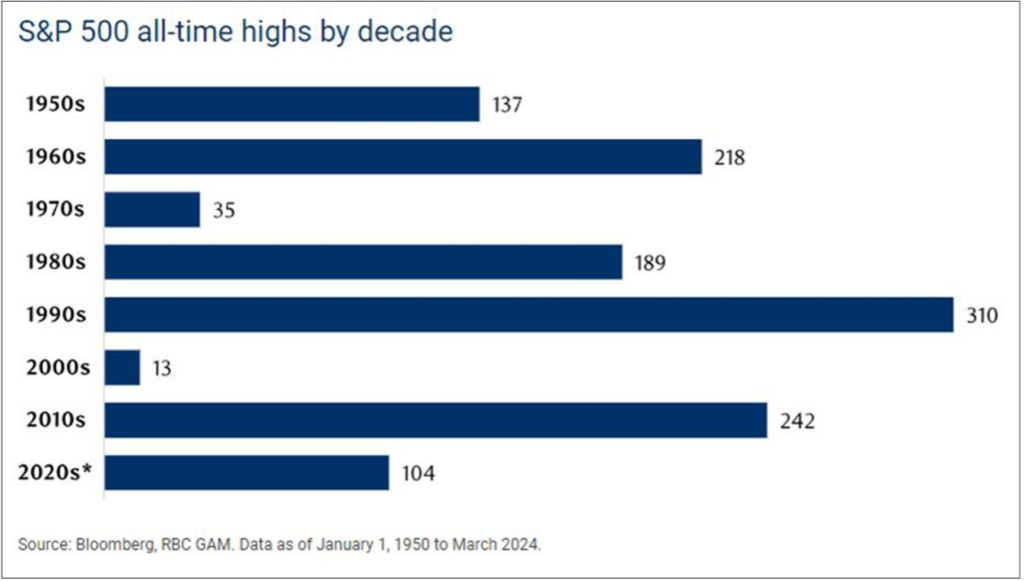

This kind of thinking is linked to trying to time the market, which is done in an attempt to avoid market highs and buy at market lows. However, this method means you could be missing out on a lot of opportunity as all-time highs are not uncommon and timing the market is almost impossible to get right. In fact, since 1950, the broad U.S. equity market has set 1,250 all-time highs along the path to its current level, which equates to an average of over 16 per year.

What do market highs mean for investors?

New market highs are not as meaningful as some people may think and are often related to continued growth of the economy and corporate profits. While there are periods of time when the economy and markets slow down, over time, improvements in productivity and innovation have continued to propel markets towards new highs. This can generate strong long-term results for investors, as long as they stay invested.

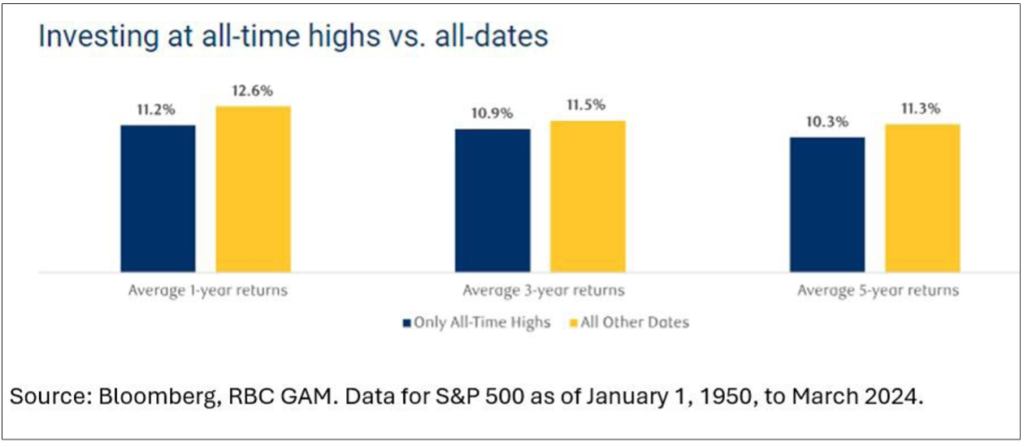

Here is how you would have done if you had invested only at all- time highs in the S&P 500 Index from 1950-2023. Some would consider this the “worst” possible time to invest, but the chart shows returns would be close to the average return of the index for one, two- and three-year periods:

All-dates refers to rolling 1-, 2- and 3-year returns starting from each trading date during this time. Returns in U.S. dollars. The graph does not reflect transaction costs, investment management fees or taxes and if such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

What is more, this chart covers some of the worst times in the stock market. This includes Black Monday (October 1987), the Tech Wreck of the early 2000s and of course the global financial crisis of 2008.

Nevertheless, when markets are sitting near all-time highs, many investors still feel uneasy about putting new money to work, with some deciding to remain in cash and waiting for a large correction before investing. However, often a significant correction never comes, leaving the investor with the regret of missing out on investment returns.

How often does a big correction follow a market high?

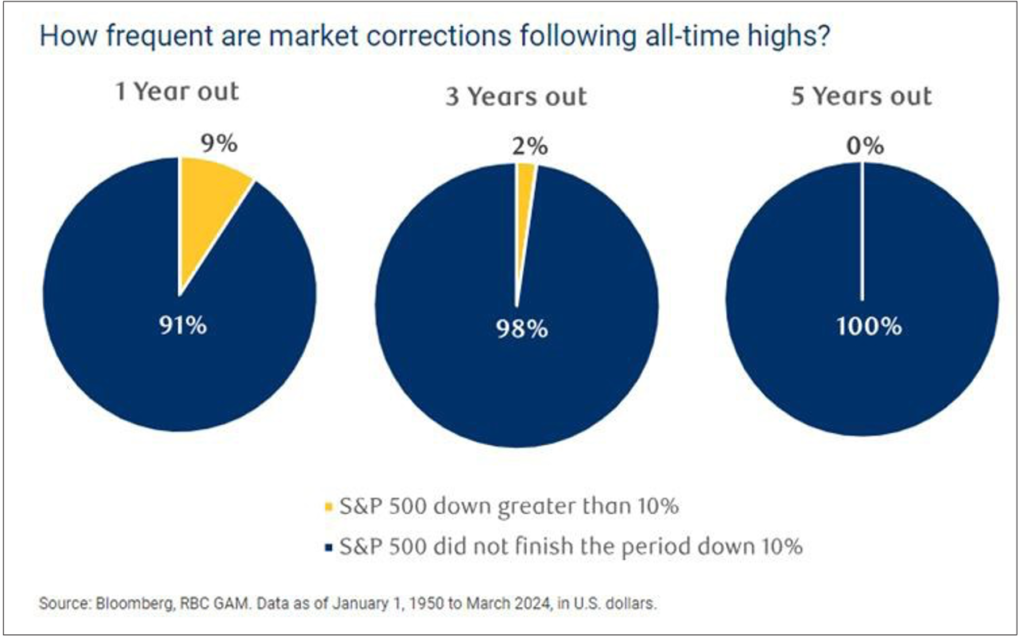

It may be helpful for long-term investors who are skeptical about investing in this environment to know just how rare market corrections from all-time highs have been. The charts below show how often the S&P 500 Index has finished down greater than 10% over various periods of time, following each of the 1,250+ all-time highs since 1950.

Key takeaways:

- Looking out just one year from each all-time high in the S&P 500, market corrections greater than 10% have occurred only 6.5% of the time.

- As we extend the time horizon, market corrections become even rarer. In fact, since 1950, the S&P 500 has never been down by more than 10% at the end of a ten-year period following any of its all-time highs.

- Long-term investors have the advantage of an extended time horizon. Staying invested can help you stick to your financial plan.

Time provides perspective for long-term investors

No one knows what lies ahead in the near term, however, history tells us stocks tend to move higher over the long term. New highs are normal and do not necessarily warn of an impending correction. In fact, they may signal that further growth lies ahead.

Next steps

As a firm of fee based financial planners with decades of experience in advising expatriates in Europe, we can help you structure your investments to ensure that your wealth lasts throughout your retirement, no matter how long that may be.

Make an appointment now

At Blackden Financial we have been advising our clients in Switzerland for the past two decades on just such decisions, so for a no obligation meeting call, +41 22 755 0800, by e mail info@blackdenfinancial.com or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.