3 min read

Several major global events – including most recently the coronavirus pandemic and the Russia/Ukraine crisis, following on from the end of 13 years of quantitative easing – printing money – have caused inflation to take off in 2022 at levels not seen in 40 years, prompting a swift repricing of many assets.

At the sharp end, many crypto currencies have gone to the wall, and even bitcoin, which its supporters believed could endlessly defy gravity, has fallen 70% since its highs of 2021. Equity markets are down 20% on average globally, as are many commercial property fund values, and the yield on 10-year US government treasuries has more or less doubled, implying a halving in value.

Rapidly rising inflation has created a high degree of correlation between the main asset classes of equities, property and bonds and there is talk of a return to the 1970’s as interest rates rises, oil prices increase dramatically and we start to see the return of strikes and demonstrations.

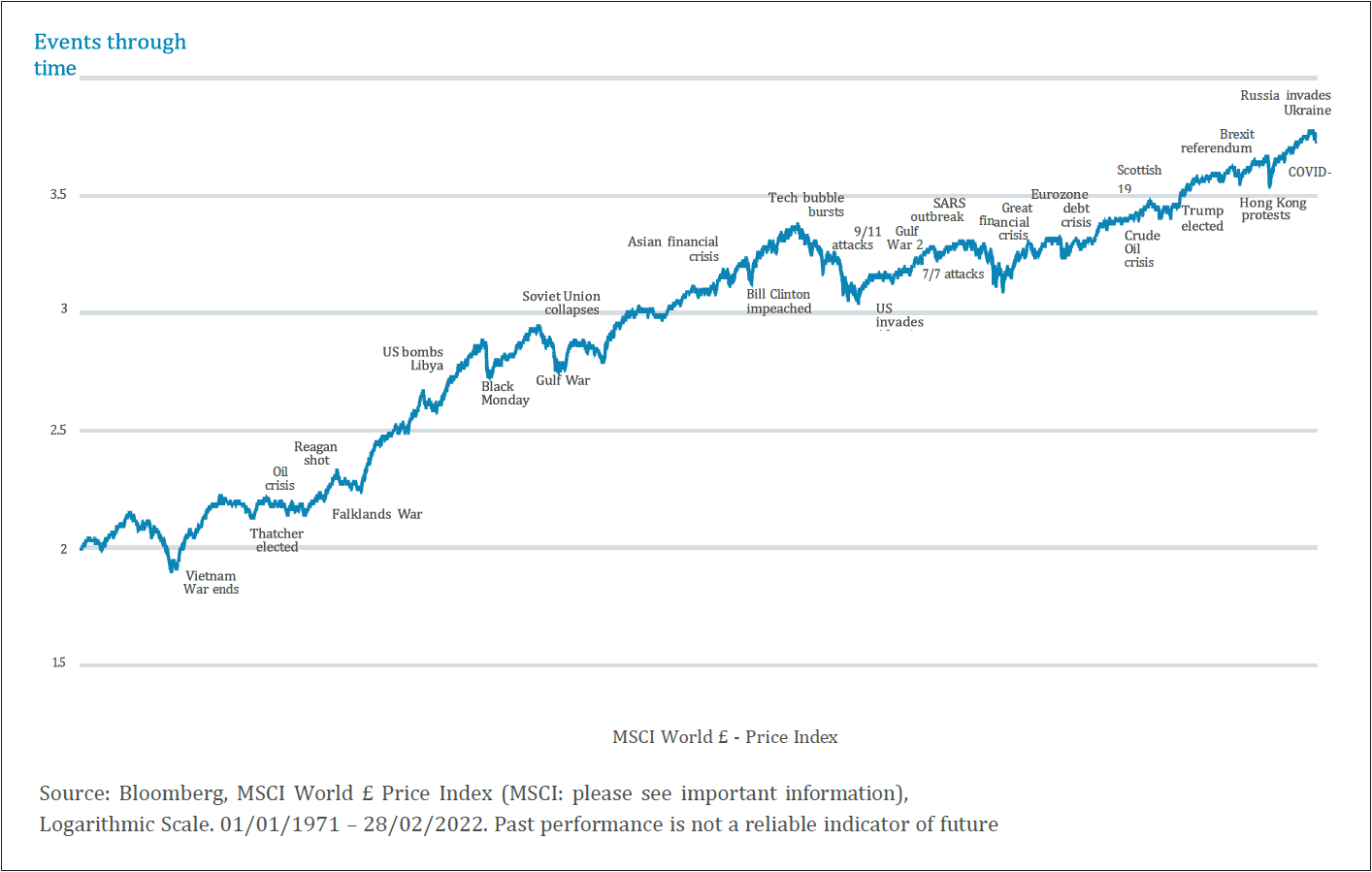

At such times, the temptation for investors is to flee financial markets or switch to cash, but history shows this would be a mistake. We want to stress the importance of remaining invested and how evidence shows time after time that missing the best performing days could have led to a portfolio’s significant underperformance over the long term.

Amidst heightened volatility, it is understandable that many are concerned about the impact on the value of their investments. But, while sharp declines in markets can naturally be disconcerting, if you want to give your investments the best chance of earning a long-term return, then it’s a good idea to practice the art of patience.

Trying to time the market can seriously damage your investment returns.

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects – trying to ‘time the market’.

But this is a strategy that carries with it the risk of missing out on some of the best days of market performance and this could have a devastating impact on long- term returns.

A different way of delivering the same message; staying invested over the 20-year period generates annualised returns of 7.9%, compared to 0.8% annualised returns if you miss the 30 best days.

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term. For example, one study of US equity mutual fund investors showed that their tendency to try and time the market was a key driver of their underperformance.

In the current environment, it is understandable that many people are concerned about geopolitical risks, and how this is being reflected in the value of their investments. To give some context, the speed at which the market entered into ‘bear’ territory (typically a 20% decline) in response to the coronavirus pandemic was the fastest in history.

Markets are always forward looking however and that means they are already pricing in a lot of bad news. It is clear that central banks globally are determined to bring inflation under control, even if this is at the cost of economic growth, and that is what markets are acutely focused on now. There may, of course, be further volatility ahead but this just brings to mind a great quote from the noted investor John Bogle, founder of the index tracking giant, Vanguard:

“The mistakes we make as investors is when the market’s going up, we think it’s going to go up forever. When the market goes down, we think it’s going to go down forever. Neither of those things actually happen. It doesn’t do anything forever. It’s by the moment.”

In summary

There is no escaping the fact that the first half of the year has been very tough, with inflation concerns giving way to recession concerns, weighing on bonds and causing a broad sell-off in stock markets. Such indiscriminate selling, however, creates opportunities for patient, long-term investors. It is vital to remain disciplined during market turbulence and focus on the long-term potential made possible by embracing selected risks in line with your risk tolerance and suitable time frames.

Throughout the turbulent first half of 2022, it remains certain that we must all remain patient, invested, and planning for the long-term future. If you are having any doubts and wish to receive trusted, qualified and regulated financial advice, we are here to put your mind at ease and help you towards achieving your most successful financial future.

Ensure your money is in safe hands, get in touch today and book your free no-obligation review meeting. You have nothing to lose and potentially lots to gain!

Email to info@blackdenfinancial.com or phone +41 22 755 0800

Or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss how our service can work for you, and how to get the ball rolling.