News from the world of usually dull Swiss pensions – we provide you with information on two important topics: the possible increase in taxation on the withdrawal of pension capital and the new purchase options for Pillar 3a.

Find out what you need to know and how you can prepare. What would these changes mean for you?

1. Federal Tax Harmonisation Act

The Swiss government is planning to adjust pension capital taxation at the federal level. This could have an impact on your pension provision. We have summarised what you need to know and what your options are.

The amendment’s background and objectives

With the aim of bringing federal finances back into equilibrium, the expert commission headed by Serge Gaillard has submitted numerous savings proposals to the Federal Council, as well as various options for revenue improvements. One of these proposals is the adjustment of the capital withdrawal tax at the federal level for pension capital from Pillar 2 (pension fund and vested benefits) and Pillar 3a.

Current practice

The federal government currently taxes the withdrawal of pension capital separately at one fifth of the tax rate for direct federal tax. This means that the tax burden on the capital withdrawn is independent of the amount of taxable income generated by the taxpayer in the reference year.

The expert group’s proposal

The expert group proposes that, at the federal level, capital withdrawals from pension schemes should bear the same tax burden as annuity payments from the second pillar. Under the new proposal, the tax burden should therefore depend not only on the amount of capital, but also on other taxable income. The tax rate would probably be determined according to the following calculation method: the pension capital is annuitised, and this notional pension is added to the remaining income in the reference year. For middle-to-higher taxable incomes, this would mean a massive increase in the capital withdrawal tax at the federal level. This adjustment is scheduled to come into force on 1 January 2028.

Example

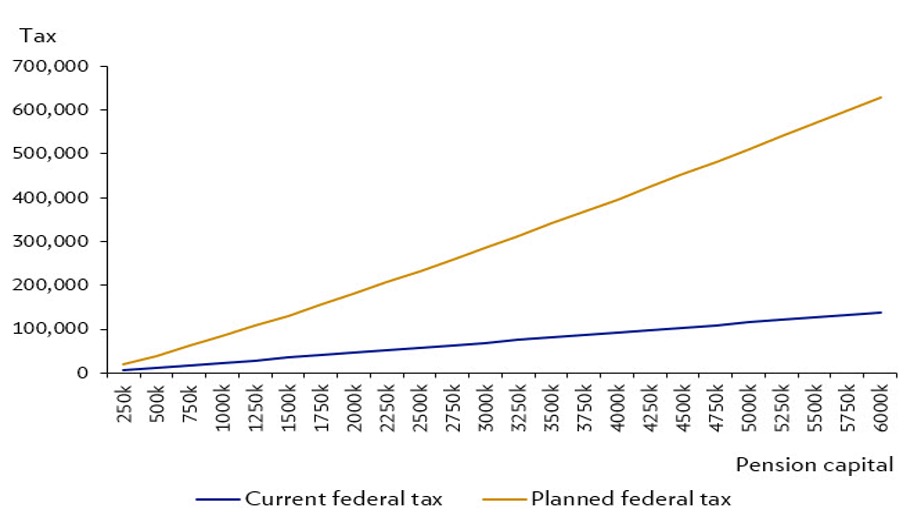

For a married person with an income of CHF 250,000 in the reference year and a capital withdrawal of CHF 4 million from the pension fund, the direct federal tax on the pension capital would more than quadruple. Instead of the previous CHF 92,000, it would now amount to approximately CHF 396,000.

Taxation of pension capital: Comparison of the current and planned tax burden for direct federal tax

Source: TaxWare/calculation by Julius Baer assuming taxable income of CHF 250,000 in the reference year (excluding the capital payment from the pension plan) and an annuitisation factor of 20 for the capital payment. k = thousand.

Next steps and open questions

The Federal Council will present the details of the planned amendment in the corresponding draft consultation by the end of January 2025. As part of this procedure, cantons, political parties, and interest groups can comment on the proposal. However, it is still unclear whether the change to the taxation of pension capital will be included in the Federal Council’s final package of measures. Should this be the case, the necessary amendment to the law at the federal level would be subject to an optional referendum.

In this case it is likely that a referendum would be held. Furthermore, it is not yet possible to predict how the cantons would react to the planned change, particularly with regard to the separate taxation of pension capital being stipulated in the Tax Harmonisation Act.

The Tax Harmonisation Act governs the harmonisation of tax laws between the Confederation and the cantons. It is possible that the cantons would also have to adapt their own tax laws.

Possible options

Assuming that the change is implemented, the following options will be available to you:

Before entry into force: You can act before the amendment comes into force and withdraw all or part of your pension capital. However, this is only possible under certain conditions: Most pension funds offer the option of partial retirement from the age of 58. You can withdraw your pension fund assets in line with the reduction in your working hours. You have already reached the earliest possible age for withdrawing vested benefits and/or Pillar 3a assets (usually from the age of 60) and can withdraw these in stages or in a one-off payment until the end of 2027.

You can withdraw your pension assets, or a part of them, in order to finance a residential property that you both own and occupy (e.g. for the repayment of mortgages).

After entry into force: Proceeding with a staggered withdrawal of pension capital over several tax years may make sense, as progression is steep with respect to the federal tax rate. Withdrawing pension fund assets in different tax periods is possible in the case of partial retirement or in the event of different pension solutions (e.g. vested benefit and/or Pillar 3a assets). As other taxable income in the reference year would be included when determining the tax rate, it is advisable to make a withdrawal in years with comparatively low income.

Conclusion

It is important to be aware of the possible impact that the planned change might have on you personally. Although it is never too early to consider the possible effects of these legislative changes, we still advise you not to rush into anything.

Further developments must be carefully monitored, and we recommend that you seek advice from a pension or tax expert if you have any questions.

2. New Purchase options for Pillar 3a

On 6 November 2024, the Federal Council decided to change the rules for restricted pension provision (Pillar 3a). From 1 January 2025, people who have paid partial to no contributions into their Pillar 3a in certain years will be able to pay these contributions retrospectively in the form of purchases.

This means that you can pay contributions into your Pillar 3a for up to ten years, retrospectively, and deduct these purchases from your taxable income. One purchase per year is permitted within the scope of a so-called ‘small contribution’, for example a maximum of CHF 7,258 in 2025.

However, in order to make a purchase, you must be entitled to make contributions to Pillar 3a, meaning that you must have earned income subject to AHV contributions in Switzerland, both in the year during which the purchase is made and in the year for which contributions are subsequently paid. In addition, a purchase requires the ordinary annual contribution to be paid in full in the relevant year.

Is there an immediate need for action?

No, as the amendment comes into force on 1 January 2025 and has no retroactive effect. This means that a gap can arise in 2025 at the earliest, which can then be covered by a purchase in 2026, for example. Gaps created before 2025 cannot be filled retrospectively.

Expert advice

At Blackden Financial we are a firm of Swiss licensed wealth managers and we have been advising our clients in Switzerland for the past two decades on just such matters. If you feel you may need advice now on how these potentially significant changes may affect you, we suggest you book a no obligation ‘discovery’ call. There is no commitment and no cost.

Contact us on +41 22 755 0800, e mail info@blackdenfinancial.com or complete our Contact Form here

One of our team will contact you and arrange a suitable time to discuss whether our service may be suitable for your situation and if so how best to proceed, step by step.