Ever felt like markets are on a wild rollercoaster ride and wondered if now is the time to jump off? You’re not alone. But here’s the truth: long-term investing success has way more to do with patience than predictions.

Let’s explain why…

Escalators, Yo-Yos & Market Mayhem

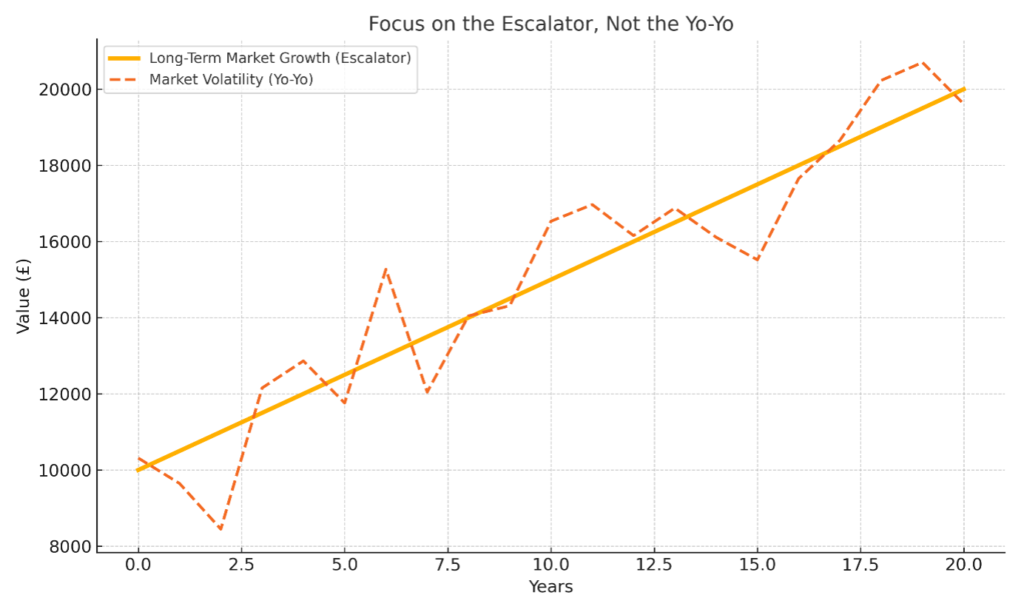

Imagine someone on an escalator, casually playing with a yo-yo. That yo-yo is the stock market—bouncing up and down every day. But the person? They’re still going up.

That’s the difference between the short-term noise and the long-term trend.

In 2020, COVID-19 sparked a global sell-off. Fast forward a few months, and markets were already rebounding. Then came the 2022 downturn… and another bounce in 2023. Now we have the Trump tariffs. It’s not new. Markets wobble. They always have. They always will.

Tariffs, elections, wars, and bad headlines might rattle things temporarily—but over time, markets adjust, companies adapt, and investors who stay the course usually come out ahead.

Don’t Let Headlines Rattle You

The 24/7 news cycle thrives on drama. Markets tumble! Recession incoming! Panic now!

But here’s what the headlines won’t tell you: volatility is normal. It’s part of the ride. And if your investments are diversified and aligned with your long-term goals, the ups and downs aren’t a crisis—they’re just noise.

Your portfolio is likely less wild than the market itself, especially if it’s built with a mix of assets that match your risk profile. Bonds cushion the ride. Diversification spreads the risk. It’s all by design.

Why Staying Invested Wins

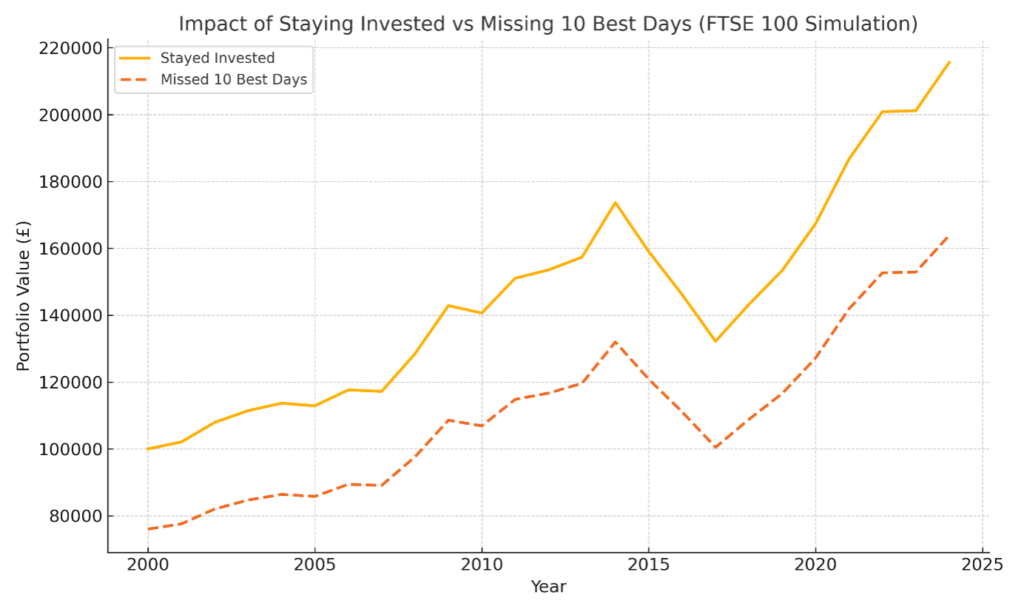

Timing the market sounds tempting. Sell at the top, buy at the bottom—easy, right? Not quite.

Some of the best market days happen right after the worst. Miss just a handful of those best days, and your returns can take a major hit.

Here’s the proof:

If you’d invested £100,000 in the FTSE 100 in 2000 and simply stayed put until 2024, you’d have £263,152.

But if you missed the 10 best days during that time? Your return drops to £200,493. Ouch.

Volatility = Opportunity (If You’re Ready for It)

Sure, market dips can be uncomfortable—but they also create opportunities. Think of it as a sale on quality businesses.

That’s how smart investment managers (like our global partners) approach things: stay calm, stay focused, and look for solid companies trading at a discount.

They’re not chasing the market. They’re buying strong businesses—ones with real earnings, innovation, and long-term potential—while others panic.

What We Believe

At Blackden Financial, we’re not about guesswork or gut feelings. We help you build a personalised financial plan, backed by world-class investment strategies, tailored to your goals, risk tolerance, and time horizon.

Your investment portfolio should work for you, through thick and thin. That’s why we focus on:

- Long-term planning, not short-term noise

- Diversified, goal-based strategies

- Transparent, disciplined investing

Whether markets are soaring or slumping, our job is to help you stay on track.

Let’s Talk

If you’re wondering how your current portfolio is holding up—or whether it’s still aligned with your goals—get in touch. We’ll walk through your risk profile, review your plan, and help you make sure you’re where you need to be.

At times such as these, having a well-defined financial plan, with clearly established objectives and risk tolerance helps you stay focused, disciplined, and less reactive to short-term market swings. It can help you to understand what to do (and just as importantly what not to do) even when things feel uncertain.

At Blackden Financial we are a firm of Swiss licensed wealth managers and we have been advising our clients in Switzerland for the past two decades on just such matters. If you feel you may need advice now on how these potentially significant changes may affect you, we suggest you book a no obligation ‘discovery’ call. There is no commitment and no cost.

Contact us on +41 22 755 0800, email info@blackdenfinancial.com or complete our Contact Form here