What happens to your investments when markets fall? Most investors don’t think about it — until it’s too late.

In a world of constant market noise, it can be hard to know how to position your investments.The truth is, no one can predict the next correction — but you can build a portfolio designed to perform steadily through all conditions:

an All Seasons Portfolio.

Let’s explain…

The Market Landscape

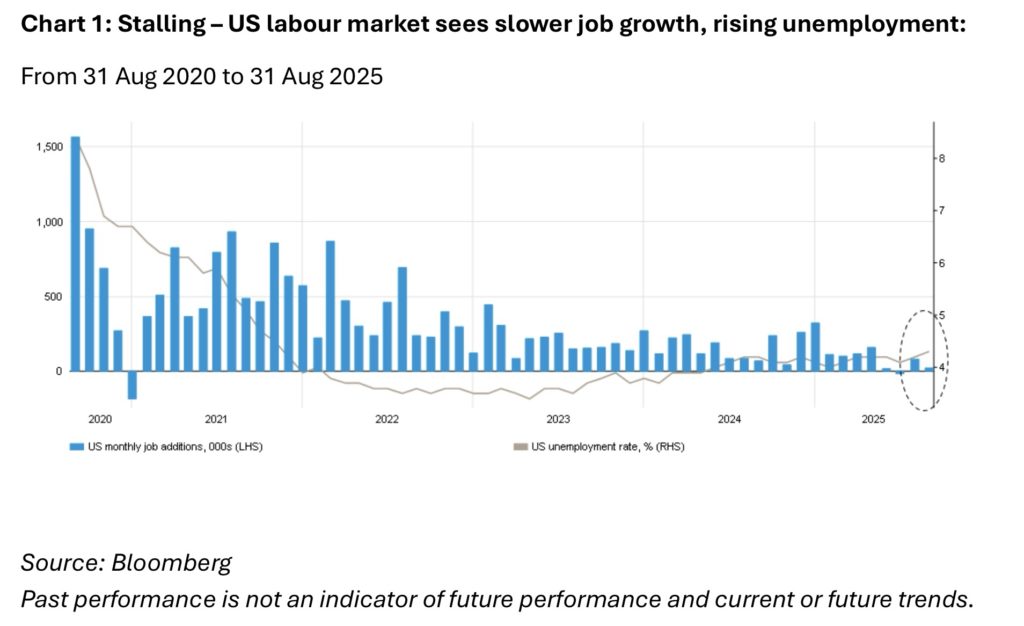

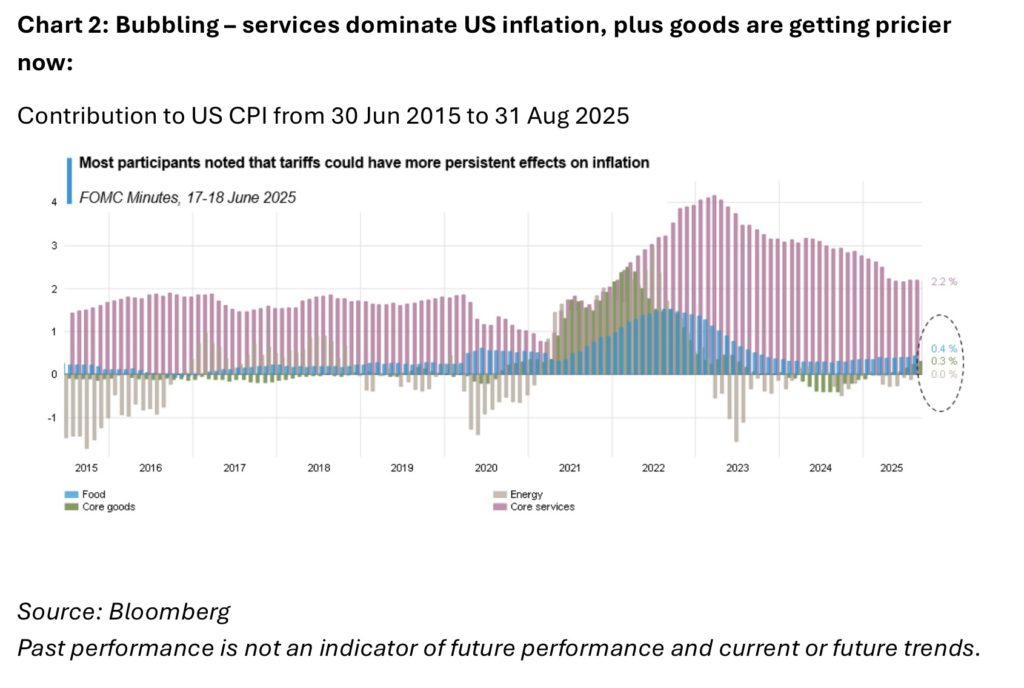

Equity markets have continued to rise, even as signs of slowing growth and sticky inflation persist in the US. Technology companies remain dominant, with artificial intelligence driving strong profits, while other sectors show more mixed results. Beyond the US, markets such as China have regained momentum, while Europe continues to face slower growth and structural challenges.

Despite these differences, global equities as a whole remain a key driver of long-term wealth. The challenge is to stay invested through uncertainty – and to smooth out the ride along the way.

Our Approach: Growth and Stability

Our multi asset portfolios are built to capture the long-term growth of global markets while maintaining effective diversification. We believe in staying engaged in equities – history shows that time in the market is more powerful than timing the market – but balance is essential.

To achieve that balance, we blend:

• Global equities for long-term growth

• Diversified bonds and credit for steady income and downside protection

• Alternative assets such as real estate, macro strategies, and gold to further stabilise returns when markets turn volatile

This mix allows our clients to participate in market growth while cushioning portfolios against shocks — a structure designed to perform through every season.

Looking Ahead

Global markets have enjoyed a strong run, and valuations, especially in the US, are now elevated. While we don’t predict when the next downturn will occur, we focus on readiness. Inflation and interest rate policy remain key risks, and diversification will once again prove its worth when conditions shift.

Now is an ideal time for investors to review key risks, and diversification will once again prove it’s worth when conditions shifts.

”Diversification is the only free lunch in investing.”

What We Believe

An All Seasons Portfolio is built to protect when markets fall and participate when they rise, keeping your wealth growing through every cycle. True sucess depends on preparation – not prediction.

Wondering if your portfolio is ready for all seasons?

Let’s Talk

With over 20 years of experience guiding clients through every market cycle, Blackden Financial knows how quickly conditions can change. Now is the time to review your portfolio and ensure it is truly ready for all seasons.

Markets can turn fast, and waiting to act often means reacting too late. We will review your risk profile, assess your plan, and help position your investments for both growth and protection — whatever comes next.

Contact us:

+41 22 755 0800

or complete our Contact Form here