The changing face of investment markets and the new world of safe havens

For decades, investors have sought refuge in US dollar cash and Treasury bonds, as historically, these ‘traditional safe havens’ assets have held their value in the event of market turmoil. However, investors are increasingly aware that some traditional safe havens now carry their own idiosyncratic risks. Welcome to the new world of safe havens, where US domestic politics, geopolitical tensions, rising debt levels and inflation are rewriting the rules that investors must navigate.

US domestic political uncertainty

Typically, US dollar cash has been the go-to currency in times of crisis. Yet political interference has begun to erode its perceived stability. President Trump has made no secret that he wants the US dollar to weaken to make US manufacturing exports competitive. Moreover, he has undermined the Fed’s independence by criticising Fed Chair Powell for not cutting interest rates. This has led some investors to reduce their dollar exposure, questioning its reliability as a store of value.

Geopolitical tensions

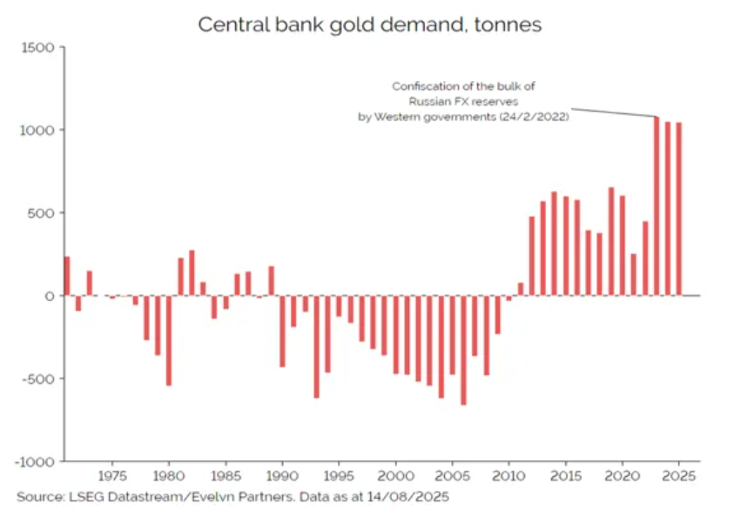

One recent geopolitical event that still has ramifications today was when the bulk of Russia’s foreign exchange reserves were confiscated by Western governments following the 2022 invasion of Ukraine. It wasn’t just a punishment—it was a precedent. Fearing sanctions, this meant that other important bond-buying countries, like China, have reduced their investments in Western government bonds. China’s holdings of US Treasuries have fallen to a record low of 23% of its FX reserves.

Given that the US Treasury market has significant influence on other government fixed income markets, like UK Gilts, geopolitical risk is now embedded in Western bonds.

Rising debts and inflation risk: The double threat

Western governments face mounting debt burdens. In the US, public debt exceeds 120% of GDP—its highest level since World War II. Reducing this debt is politically problematic, as voters rely heavily on expensive welfare programs, and some are resistant to spending cuts. Without credible fiscal reform, government bonds carry more risk tied to the long-term sustainability of public finances.

Furthermore, inflation risk has also returned after decades of disinflation. Following the post-Covid stimulus boom, inflation surged globally in 2021 and 2022, prompting central banks to raise interest rates aggressively. This led to simultaneous corrections in both equities and bonds, undermining the traditional role of fixed income as a portfolio stabilizer. Investors expecting bonds to cushion equity volatility back then were left disappointed.

Is Bitcoin considered a safe haven asset?

Bitcoin (a cryptocurrency) is not yet a fully-fledged safe haven, but its role as a portfolio diversifier is evolving. The UK’s Financial Conduct Authority (the country’s primary financial regulator) will allow retail investors to access crypto exchange-traded notes from 8 October.

Bitcoin’s fixed supply, resistance to inflation and monetary debasement, and 24/7 trading offer unique advantages. Moreover, major asset managers and corporations are holding Bitcoin as a long-term store of value. However, its volatility, correlation with equities, and regulatory uncertainty remain significant hurdles.

The resilience of gold in a changing landscape

Gold continues to prove its worth. Central banks have purchased over 1,000 tonnes annually for three consecutive years up to 2024, compared to an average of 48 tonnes sold per year between 1970 and 2021.

This structural demand has reduced the opportunity cost of holding gold, even without yield. In times of geopolitical stress and inflation, gold continues to shine—literally and figuratively. The gold price was largely flat in 2022, when most equity and bond markets were down, and has nearly doubled since the end of that year.

Conclusion

In today’s complex environment, investors must be more discerning about what truly diversifies their portfolios. Bonds may still have a role to play, but their effectiveness depends on macroeconomic conditions and fiscal credibility. Gold offers structural support from both institutional and retail demand, while Bitcoin is being discussed as a potential alternative, albeit with caveats. The key is not to rely on labels, but to understand the underlying risks and drivers of each asset. Safety, it turns out, is no longer a given—it must be earned.

What We Believe

At Blackden Financial, we’re not about guesswork or gut feelings. We help you build a personalised financial plan, backed by world-class investment strategies, tailored to your goals, risk tolerance, and time horizon.

Your investment portfolio should work for you, through thick and thin. That’s why we focus on:

- Long-term planning, not short-term noise

- Diversified, goal-based strategies

- Transparent, disciplined investing

Whether markets are soaring or slumping, our job is to help you stay on track.

Let’s Talk

If you’re wondering how your current portfolio is holding up—or whether it’s still aligned with your goals—get in touch. We’ll walk through your risk profile, review your plan, and help you make sure you’re where you need to be.

At times such as these, having a well-defined financial plan, with clearly established objectives and risk tolerance helps you stay focused, disciplined, and less reactive to short-term market swings. It can help you to understand what to do (and just as importantly what not to do) even when things feel uncertain.

At Blackden Financial we are a firm of Swiss licensed wealth managers and we have been advising our clients in Switzerland for the past two decades on just such matters. If you feel you may need advice now on how these potentially significant changes may affect you, we suggest you book a no obligation ‘discovery’ call. There is no commitment and no cost.

Contact us on +41 22 755 0800, email info@blackdenfinancial.com or complete our Contact Form here