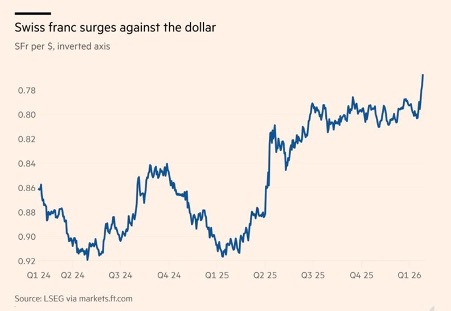

While global attention has been fixed on the US Dollar and Yen recently, the Swiss Franc has quietly surged to its strongest level in over a decade.

Here is why this matters for markets worldwide, and for Swiss resident investors in particular:

The “safe haven” effect

Investors are flocking to stability. With gold breaking $5,000 per ounce and political uncertainty rattling major powers, the Swiss franc has emerged as the go-to refuge. It has risen 3% this year against the dollar, following a remarkable 14% gain last year.

The Swiss National Bank’s dilemma

A currency this strong is a mixed blessing. It helps keep inflation extremely low, currently just 0.1%, but it also puts enormous pressure on Swiss exporters. It also presents the Swiss National Bank with a tough choice:

- Cut rates? Already at 0%, going negative again is a step they are reluctant to take.

- Intervene? Direct market action could trigger accusations of currency manipulation by the US and create diplomatic tensions.

The global context

When the world’s economic anchor, the US dollar, shows instability, money does not vanish; it moves. Capital is increasingly flowing toward perceived stability, with the Swiss franc benefiting from this shift.

In today’s volatile markets, true stability has become the most sought-after and most valuable asset.

The local (Swiss) context

If you are a resident of Switzerland, the strength of the Swiss franc has meaningful implications for how your wealth performs globally. While it enhances purchasing power and protects capital, it can also quietly dilute returns on international investments.

For example, if you held a global focussed equity portfolio in 2025, weighted my global market capitalisation, in US Dollar terms you would have made well over 20%. In Swiss Franc terms last year, however, you would have struggled to make mid-single digit returns.

Periods like this often create both hidden risks and unique opportunities across portfolios, which makes thoughtful currency positioning, diversification, and financial planning more important than ever.

Now is an ideal time to review your financial plan and ensure it remains aligned with your long-term objectives in a changing global landscape.

At Blackden Financial, we’ve spent over 20 years guiding clients through every twist and turn the markets can throw at us, always seeing things from a Swiss perspective. Things can change quickly and now is a good moment to take a step back and see if your portfolio is really ready for whatever comes next.

Markets don’t wait, and neither should your planning. We’ll sit down with you, review your risk profile, take a fresh look at your plan, and help position your investments for both growth and protection — so you’re prepared, no matter what the future brings.